Few Peruvian quinoa exporters at Biofach

Only three Peruvian quinoa exporters had booked a booth a the Biofach trade fair last month. This is a stark difference with the dominant presence of Peruvian quinoa in previous years, as the country is one of the two main suppliers of quinoa to global markets – the other one is Bolivia. And a large part of the quinoa consumed around the world is certified organic. What’s holding back the Peruvian quinoa sector? The short answer is: a chemical compound called phosphonic acid (or phosphonate), often found in Peruvian quinoa. As the levels found are very low, this does not pose a safety risk to consumers. Nonetheless, every detection above the detection limit of 0.01 ppm constitutes a possible infraction of the European organic legislation. Hence, organic quinoa exports from Peru to Europe decreased dramatically in 2023.

Phosphonic acid in organic agriculture

Organic agriculture is much more than farming without pesticides, as it also means managing soil and plants differently. In the organic sector, however, there is zero (or very little) tolerance for unauthorised substances. Consumers expect organic products to be totally free from such substances, even though many of them are present in the environment. Strictly speaking, organic regulations do not exclude the presence of unauthorised substances, but they do not allow their use.

Phosphonic acid, in this regard, is a case in point. Its detection may point to the use of an unauthorised substance in farming, but there are other possible origins as well. One of them is the use of guano, or bird droppings, collected from islands off the coast of Peru, as a natural fertilizer. A scientific article published in Food Control in August 2023, provides evidence that phosphonic acid (or phosphonate) occurs naturally in soils and plants.

The article also shares information from the Eurofins lab test results for phosphonic acid for the years 2017-2022. An evaluation of 120000 samples by Eurofins showed that 34% of conventional samples and 27% of organic samples contained phosphonate. A refined testing method achieving a limit of quantification (LOQ) of 0.01 mg/kg even yields higher results: 40.63% of all samples from organic and 43.42% from conventional agriculture contained traces of the compound, and over 90% of organic samples of chickpeas, lentils, buckwheat, peanuts and wine. In short, the chemical is present everywhere, and often without a link to use as a fungicide.

Procedures under organic regulations

Should we be worried about this? If the presence is below the food safety limits (maximum residue limits) specified in EU law, products are deemed to be safe for consumption. For products from conventional agriculture, such a presence does not hinder their commercialisation. For organic products, however, the mere detection of the substance (above the detection limit of 0.01 ppm) will mean that the product is not marketable as organic. The organic regulations furthermore state that, such a detection should also lead to an investigation into its origins. If the detection is not caused by unauthorised use, the organic integrity is not harmed, and the product could in theory still be marketed. However, in practice most organic traders prefer not to market such a product.

At the Biofach trade fair, one Peruvian exporter indeed claimed that he could provide such proof. He validated his claim with an official letter from a control body, stating that 2000 tons of quinoa could be marketed as organic, even if there were traces of phosphonate.

So, how is this situation affecting the Peruvian quinoa industry? Some interesting patterns have developed in 2023, as trade statistics and industry sources tell us.

Reduced Peruvian quinoa exports to Europe

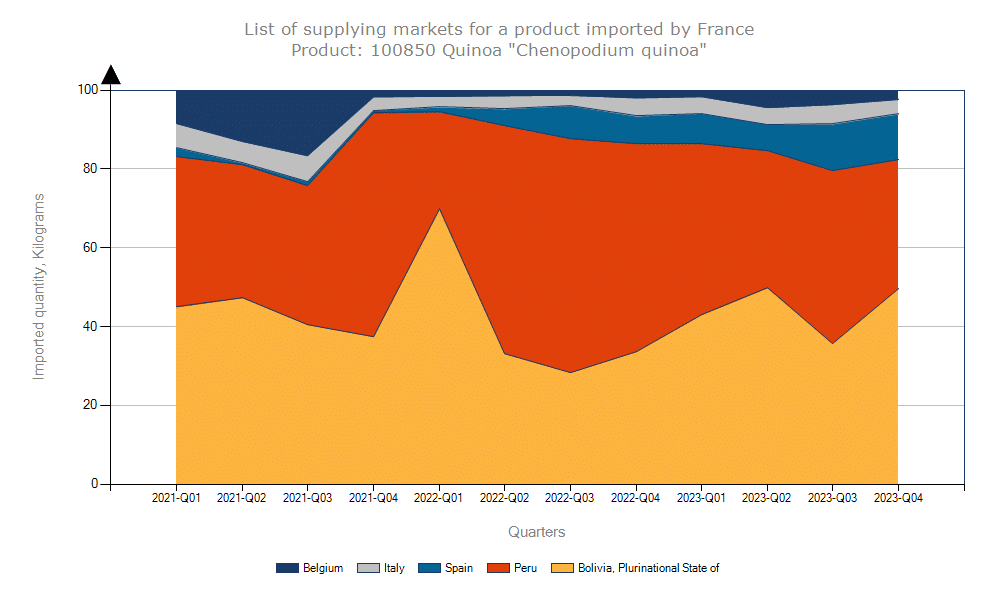

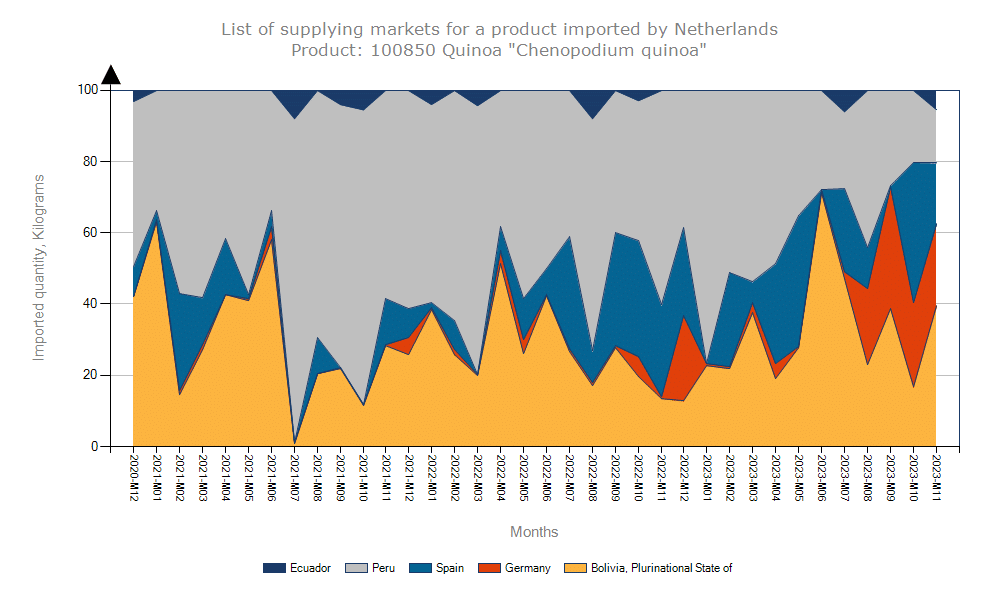

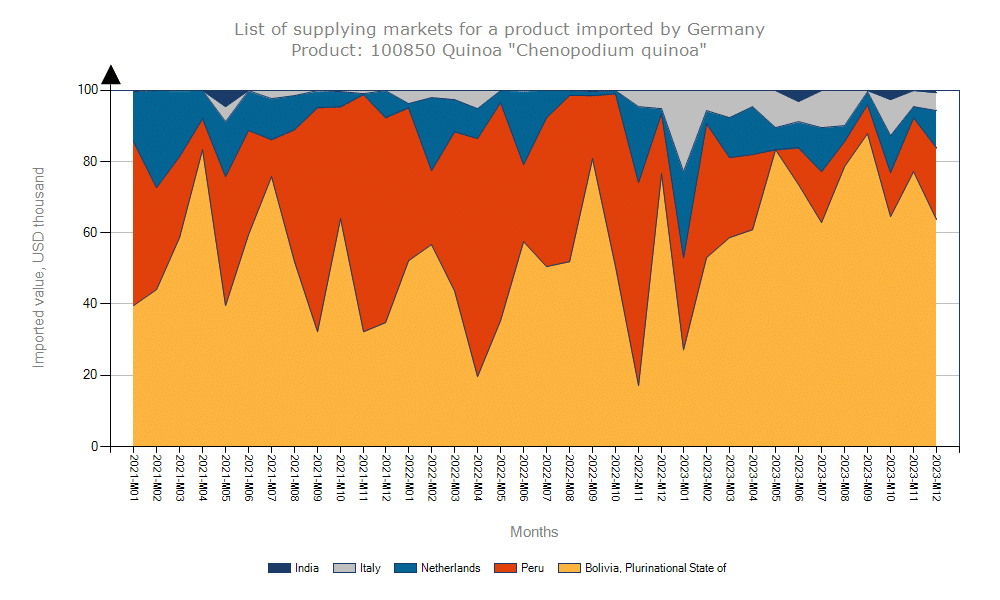

Data from ITC Trademap (accessed 28 February 2024), clearly show how in 2023 imports from Peru to Europe have dropped a lot.

In 2022, the largest European importer was France, followed by the Netherlands and Germany. As the chart shows, in the last quarter of 2023, Peru supplied less than 40% to the French market, compared to well over 50% in 2022. France replaced Peruvian supplies mostly with Bolivian and Spanish. In 2022, France imported a total of 6.6 thousand tons of quinoa.

The Netherlands, accounting for 4.9 thousand tons of quinoa imports in 2022, shows a similar pattern, but even more extreme. In November 2023, the import share of Peruvian quinoa in Dutch imports was less than 20%, while a year earlier it was 50%. Peruvian exports to the Netherlands started dropping in February 2023. Bolivia, Germany and Spain compensated the reduced Peruvian imports.

Germany, the third largest European importer with 4.8 thousand tons in 2022, show the same pattern. Since January 2023, imports from Peru started dropping, to reach less than 20% in December 2023. Bolivian, Dutch and Italian imports replaced the Peruvian ones.

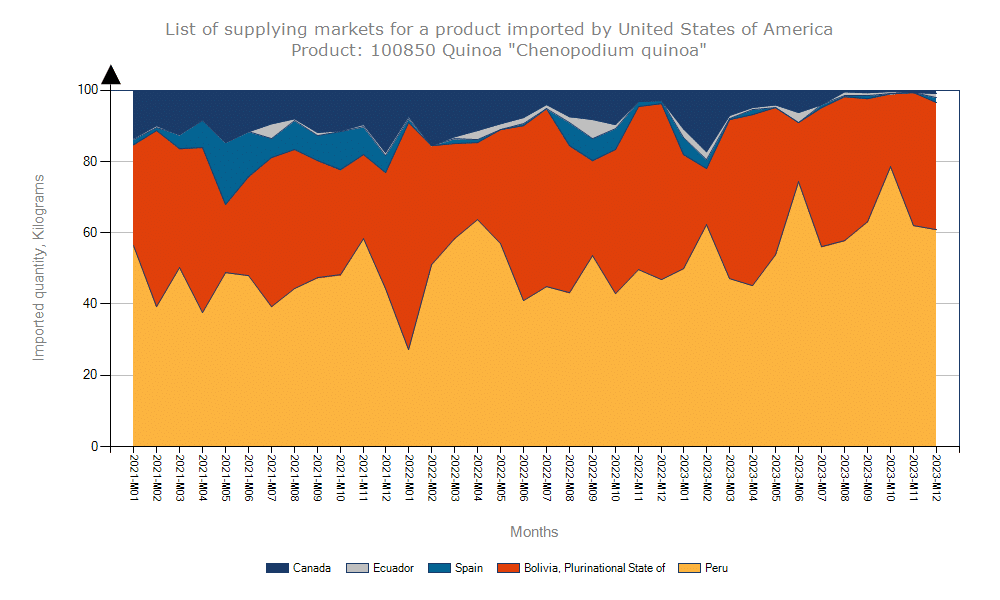

Increased quinoa exports from Peru to the USA

So, where did the Peruvian quinoa go? In sharp contrast to Europe, the United States increased its share of Peruvian imports in 2023. In the last quarter of 2023, Peru’s share in the US market averaged about 65%, compared to about 55% a year earlier. The increase came at the expense of primarily Canada and to some extent Bolivia. The USA is the world’s largest quinoa importer, accounting for 30.2 thousand tons of quinoa in 2022.

Intense Peruvian buying activity in Bolivia

Since the start of the harvest season in Bolivia in June 2023, Bolivian exporters reported intense, disruptive buying activity from Peruvian companies in Bolivia. When the problems with Peruvian quinoa started to manifest itself, Peruvians started buying Bolivian quinoa. They could so either officially or unofficially. Officially from Bolivian operators, who would then export it to Peru. Unofficially if they buy it directly, from farmers or middlemen, and then smuggle it to Peru. According to witnesses, the border between Peru and Bolivia is very open for transit of quinoa. By October 2023, the situation in Bolivia had become so extreme that Bolivian exporters claimed force majeure regarding their sales commitments. Purchasing prices had shot up by 50% in only three weeks time (Statement from Bolivian quinoa exporters, October 2023).

Outlook for 2024

Will Peru recover some lost ground in Europe? To resume its organic exports, Peru will need to address the problem of phosphonic acid. Under Europe’s organic regulation, they can do this in two ways. One way is to change the production system making sure the substance is not present any longer. The other way is by showing that the presence is not due to unauthorised use. None of these options is easy to accomplish, especially in a country like Peru with such diverse growing conditions. A thorough understanding and investigation into the sources of phosphonic acid will be necesary in either case.

The more likely scenario is that Peru will continue to send its organic quinoa to the USA, and leave the European market to its main competitor, Bolivia. For the Peruvian quinoa industry, with exports of roughly 100 million US$ per year, this is also a risky strategy though. What if the organic regulators in the USA start cracking down on phosphonic acid as well? Most likely, the escape route to the USA would then be closed. It thus appears that the presence of a single compound, of which the source is unknow, puts at risk the entire quinoa sector. It is therefore recommendable that stakeholders start clarifying the origins of and solution to the phosphonic acid problem in Peru.